syifbhuiyan

The Airbnb Effect: Impact on NYC Housing

Syif M. Bhuiyan | Data Analyst

Back to Home

Goal

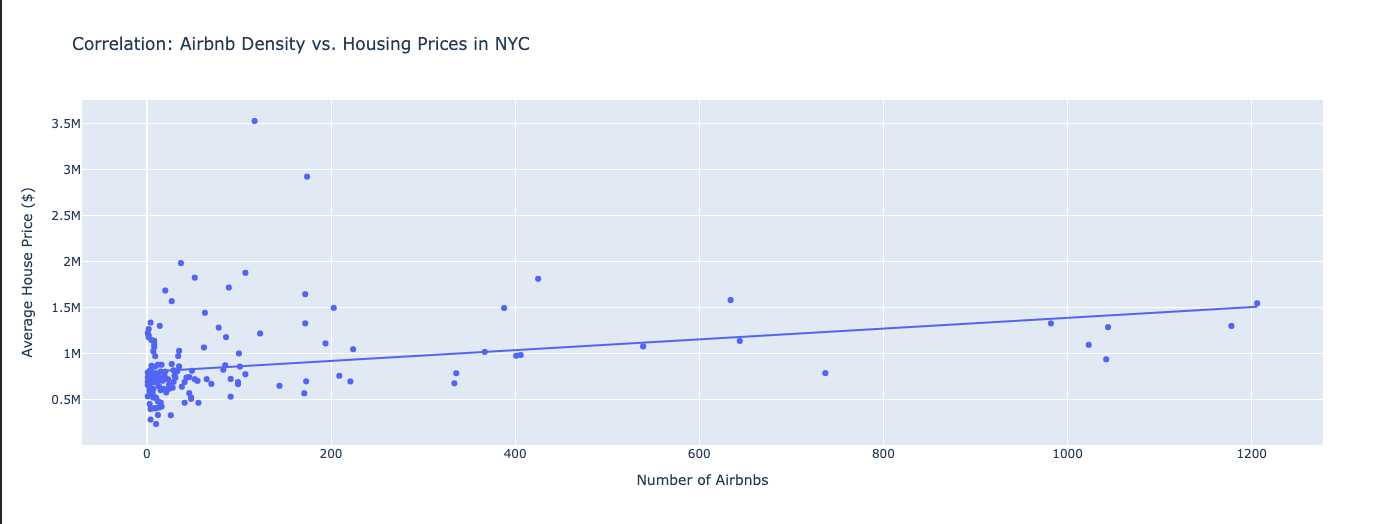

Determine if “platformization” of housing (via Airbnb) correlates with higher local housing costs in New York City neighborhoods.

Tools Used

- Python (Pandas): For cleaning and merging disparate datasets.

- Statsmodels (OLS Regression): To statistically quantify the relationship.

- Plotly: For geospatial and regression visualization.

- GitHub: For version control and reproducibility.

Project Overview

In the debate over urban housing affordability, short-term rentals are often cited as a driver of rising costs. This project utilizes Computational Social Science techniques to empirically test this theory using real-world data from Inside Airbnb and Zillow Research.

I built a data pipeline to merge listing data with neighborhood-level housing value indices (ZHVI) across 164 NYC neighborhoods to perform a regression analysis.

Key Insights & Findings

-

Statistically Significant:

The model yielded a P-value of 0.000, confirming the relationship is non-random. -

The “Airbnb Premium”:

The regression coefficient suggests that for every 1 new Airbnb listing added to a neighborhood, average annual home values increase by approximately $585. -

Correlation vs Causation:

While the model explains approximately 10% of price variance (R-squared = 0.097), it highlights that short-term rental density is a significant market signal, functioning alongside other variables like location desirability.

Code Snippet: The Regression Model

# Running Ordinary Least Squares (OLS) Regression

import statsmodels.api as sm

Y = master_df['avg_house_price']

X = master_df['airbnb_count']

X = sm.add_constant(X)

model = sm.OLS(Y, X).fit()

print(model.summary())

Methodological Note

While this OLS regression establishes a statistically significant correlation ($R^2=0.097$) between short-term rental density and housing prices, I acknowledge that correlation does not imply causation. A future iteration of this study would ideally employ a Difference-in-Differences (DiD) approach or Instrumental Variable (IV) analysis to better isolate the causal impact of Airbnb market entry.